Global Ecommerce 2020 from eMarketer: key facts

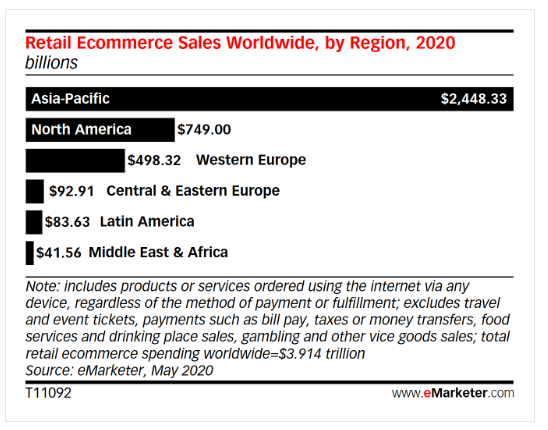

Business Insider and eMarketer analysts estimate that the volume of global e-trade will amount to $3.914 trillion in 2020. See the main results of their report below.

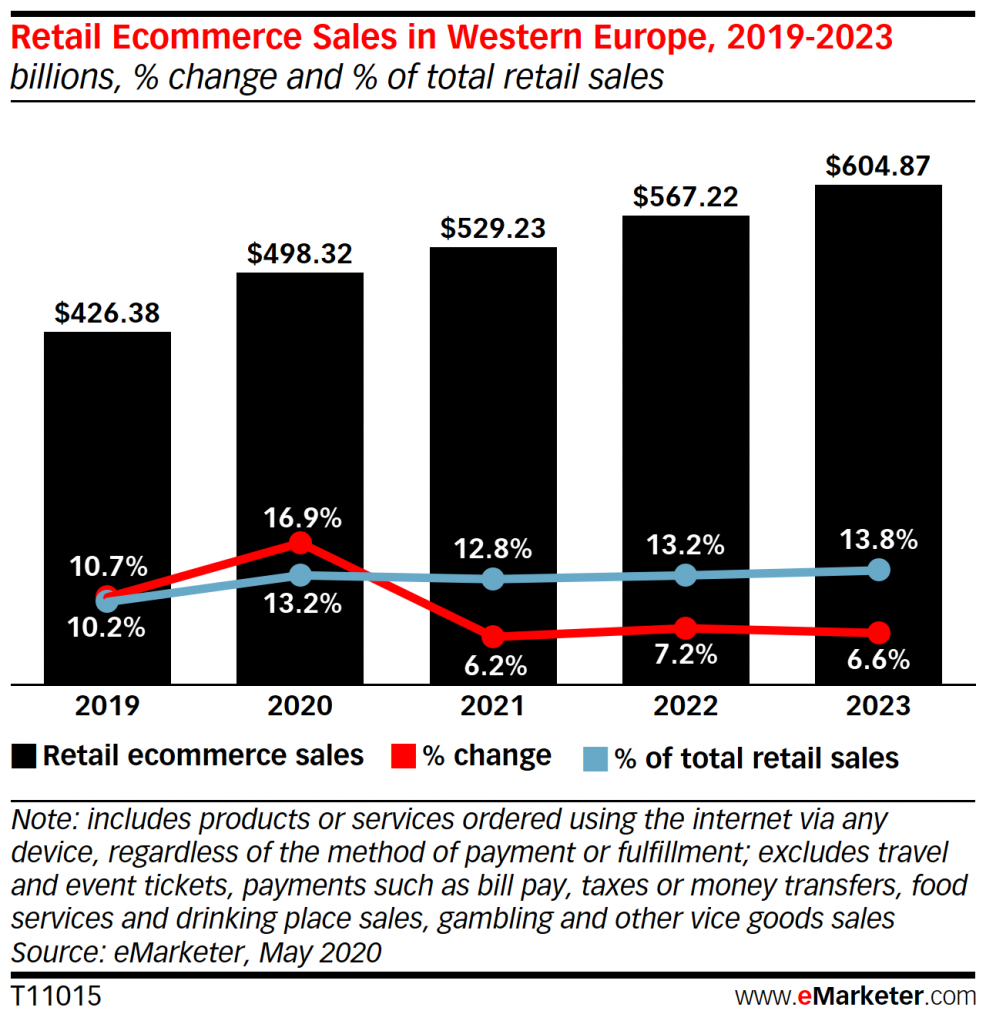

Online sales in Western Europe, with an overall decline in retail turnover by 9.9%, will grow by 16.9% reaching $498.32 billion by the end of the year. The earlier predicted figure is 8.8%, which is $10.83 billion less than the current forecast.

“We previously expected retail sales in eCommerce to account for 11.0% of total retail by the end of the year, but we revised this figure to 13.2%,” the report says.

A number of European countries will grow significantly above the general market. Thus, online stores in Spain will increase their sales by 22.9%, the highest rate in Western Europe and one of the fastest in the world. The market of the Netherlands will grow by 21.9%, and Italy – by 20.5%.

Due to China’s overwhelming dominance in the global e-commerce market, the Asia-Pacific region holds a 62.6% share of the total market. North America and Western Europe will have shares of 19.1% and 12.7% respectively by the end of the year.

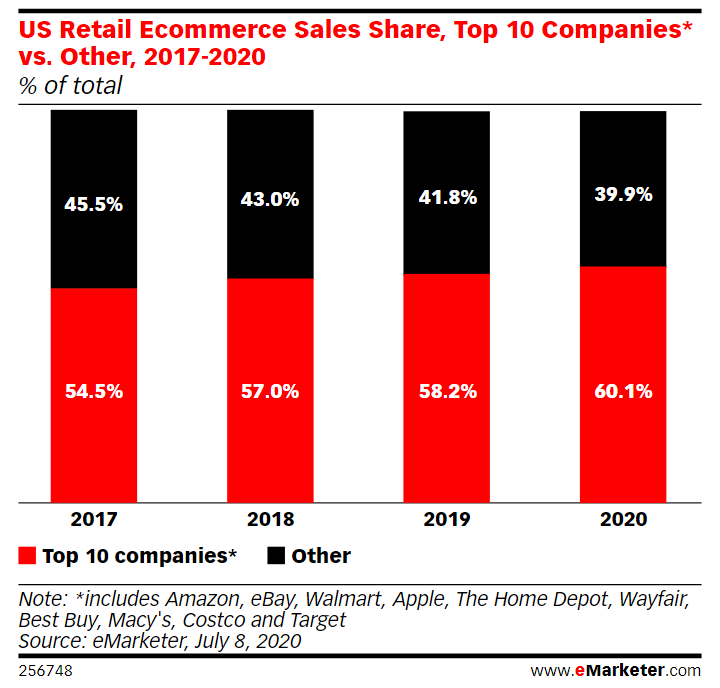

In the United States, the top ten online retailers will account for 60.1% of total e-commerce turnover in 2020, up from 58.2% last year. Top 5 sellers: Amazon, eBay, Walmart, Apple, the Home Depot. In the past few months, consumers have increasingly turned online to networks such as Target and Costco. During the pandemic, each of these companies experienced a surge in online sales.

“We expect that the top 10 retail companies engaged in e-commerce will increase the volume of online sales at a faster pace. They will increase by 21.8%,” the authors of the report believe.

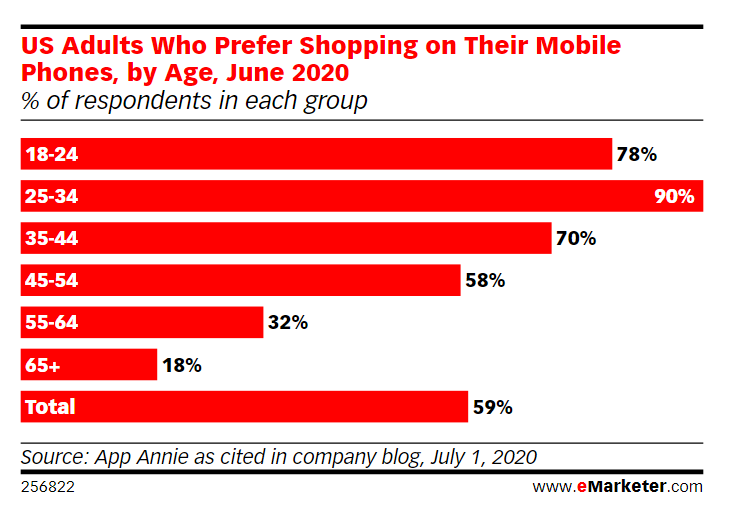

Mobile commerce has shown a solid growth recently: in the UK, it accounts for about half of all online orders. The most active of the European countries is growing m-commerce in Germany. In the US, the pandemic has shown that young people also prefer smartphones to computers.

This year the number of “mobile buyers” in the US (those who used their mobile device to make at least one purchase through a mobile site or application) will reach 167.8 million. By 2024 this figure will grow to 187.5 million people, or two-thirds of the population of the USA.

In the 18-24 age group, this is 75% of users, and in the 25-34 group – all 90%. But even here, China will overtake other countries: the average time that Chinese people spend daily on their smartphones will grow this year to 2 hours 43 minutes, which is 17.9% more than a year earlier.

*our special thanks to www.e-pepper.ru