E-commerce merchants are literally at the mercy of the digital checkout systems tied to their web stores. For retailers, what happens on the other side of the “pay” button is critical to avoiding denied approvals. Online sellers cannot survive without a strong checkout page.

The process can be a dizzying integration of numerous moving parts. Authentication, currency conversions, and approval rates all must work together to ensure a quick and complete transaction so merchants can bring their business to the next level.

How fast money moves in a transitioning digital economy is a sign of efficiency and health. So what does it mean when $18 trillion in U.S. business-to-business payments takes days to clear and land in bank accounts?

For merchants, it means lost efficiency and lost time to put cash to work. For consumers, such delays mean they do not have access to funds that many of them need right now. For both parties, it also means failed transactions.

This process is changing slowly. The payment system that runs much of the online transactions is 40 years old. Some investors have taken notice. A new behind-the-scenes payment system is slowly taking over.

Developed by The Clearing House, RTP (Real-Time Payments) is backed by major U.S. banks and has been adopted by nearly 40 percent of large enterprises in the U.S.

RTP represents the new frontier for payments and will likely become the new standard. Already, more than one-third (36 percent) of large enterprises in the U.S. use Real-Time Payments, which was launched in 2017 in the United States. However, beyond U.S. borders, RTP is in much bigger use.

RTP’s prominence is likely to expand. Levvel Research’s “2021 Real-Time Payments Market Report,” showed that 66 percent of companies in the U.S. indicate they are likely to adopt RTP in the next two years. The technology has already gained momentum in other countries.

RTP is a big step to speeding up and modernizing payments, accounting, and money movement. RTP enables financial institutions and businesses to send and receive payments in real time. The process is much faster than checks, ACH, or wires, which can take up to three days to clear.

Other than speed, RTP differs from the way B2B payments are made today in that it enables three new processes.

- Better data to drive better insights.

With non-RTP transactions, vendors, at best, may see their clients’ payments post to their bank account. RTP enables data to transfer with the payment, so companies get visibility into invoices, dates, purchase orders, and more.

This gives companies an advantage in responding to customer needs and has potential to improve their finance function and decision-making.

RTP is always available. This provides merchants with more flexibility than traditional banking hours that constrain non-RTP payments.

- The mitigated risk of payment failure.

RTP payments are irrevocable. Payment instructions are not sent unless there are sufficient funds. This reduces the risk of payment exceptions.

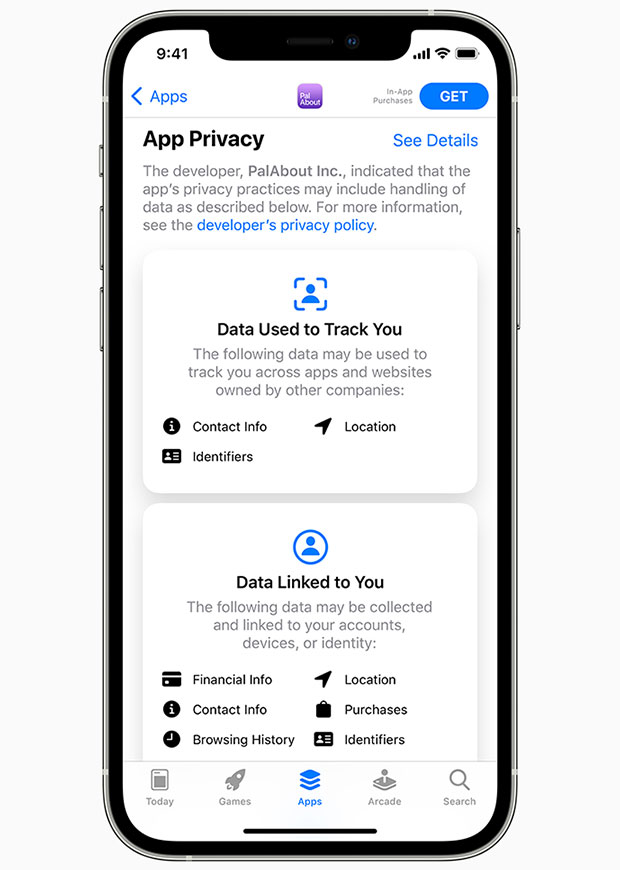

From a merchant’s viewpoint, three levels of optimization are needed for a seamless checkout experience. They are improvements to checkout, integration, and issuer responses.

They can provide a customer with the most seamless experience, increasing the likelihood of completing a purchase. This also will make it easy for merchants to keep track of their transactions and get the most from their shoppers.

- Checkout optimization reduces the number of steps a consumer needs to take when paying for goods online. Fewer steps mean less frustration and fewer abandoned baskets.

- Integration optimization means not making consumers insert their credit card details into a website they do not trust. So ensuring a payment gateway that is properly configured and integrated into the checkout process with the same look and feel as the rest of the experience is critical.

That optimization should include the authorization process and structured data that informs merchants about their business transactions. This way, merchants can quickly identify where any declines come from in the processing chain, what the reason for it is, and oversee the smooth flow of transactions.

- Issuer optimization is the final cog in the payment wheel. Once payment has passed through the gateway and the acquirer, the final decision on whether to authorize a transaction ultimately sits with the issuer.

What happens on the other side of the pay button is critical. A maze of steps must execute without glitches to complete transactions successfully. Even if a customer commits to a purchase, enters the details, and clicks the pay button, the order will not necessarily be successful, as all sorts of variables such as authorization rates come into play here.

Multiple parties are involved in every transaction. Each has the power to cause a transaction to fail and impact a merchant’s approval rates. That is why it is so vital that merchants work with a payments partner that looks after this process for them.

RTP is inevitable because the speed of business and economies is only getting faster. Companies cited immediate access to funds as the most appealing benefit of RTP. Also, 76 percent of companies believe RTP will provide them with a competitive advantage.

As more companies adopt, others will, too, in order to stay competitive. In addition to RTP, the Federal Reserve is forging ahead with its real-time payment system, FedNow, which is expected in 2023 or 2024.

For consumers, real-time payments will mean instant access to funds with no more waiting for checks to clear. For some consumers who live paycheck to paycheck, that could reduce the need for expensive, short-term loans or reduce chances of bank overdrafts.

In addition, RTP will speed up operational requirements of foundational back-office processes like accounts receivable and accounts payable, potentially leading to lower costs. It goes without saying that these savings can result in increased incremental value for their customers.

“Ignore Your Customers (and They’ll Go Away)” presents a step-by-step guide to building winning customer service culture to transform your company. Follow stories from innovative and successful companies, including Amazon and The Ritz-Carlton Hotel Company, and learn what it takes to turn routine customer interaction into lifelong engagement and loyalty.

“Ignore Your Customers (and They’ll Go Away)” presents a step-by-step guide to building winning customer service culture to transform your company. Follow stories from innovative and successful companies, including Amazon and The Ritz-Carlton Hotel Company, and learn what it takes to turn routine customer interaction into lifelong engagement and loyalty. In “Masters of Scale,” LinkedIn founder Reid Hoffman teams up with the executive producers of the “Masters of Scale” podcast to offer hard-fought lessons from iconic companies and disruptive startups. Taken from more than 100 interviews, this book offers collective insights distilled into a set of counterintuitive principles. Learn to find a winning idea and turn it into a scalable venture. Kindle $13.99.

In “Masters of Scale,” LinkedIn founder Reid Hoffman teams up with the executive producers of the “Masters of Scale” podcast to offer hard-fought lessons from iconic companies and disruptive startups. Taken from more than 100 interviews, this book offers collective insights distilled into a set of counterintuitive principles. Learn to find a winning idea and turn it into a scalable venture. Kindle $13.99. “The Future of Money” follows the current state of money and the impact of disruptive digital currencies. Explore the positive developments, such as greater efficiencies and improved access, and learn how to guard against the dangers of what’s to come.

“The Future of Money” follows the current state of money and the impact of disruptive digital currencies. Explore the positive developments, such as greater efficiencies and improved access, and learn how to guard against the dangers of what’s to come. This is an updated and expanded version of the best-selling “Launch,” a guide for starting new products and businesses. This new edition features chapters on applying social media in your launches, live-streaming to deliver content, and using paid traffic and advertising.

This is an updated and expanded version of the best-selling “Launch,” a guide for starting new products and businesses. This new edition features chapters on applying social media in your launches, live-streaming to deliver content, and using paid traffic and advertising. “The Startup Growth Book” teaches entrepreneurs and marketers how to build sustainable, scalable growth, channel by channel, with no advertising. Learn how to scale organically using multiple channels, such as email, organic search, social media, and more. Drive your growth without outsourcing to an agency or a third-party marketing team.

“The Startup Growth Book” teaches entrepreneurs and marketers how to build sustainable, scalable growth, channel by channel, with no advertising. Learn how to scale organically using multiple channels, such as email, organic search, social media, and more. Drive your growth without outsourcing to an agency or a third-party marketing team. “Social Media Marketing” is a resource for anyone who has little-to-no social media presence. Learn how to grow an interactive follower base organically. Get proven strategies for Facebook, Twitter, Instagram, YouTube, and Snapchat. Increase interaction of your followers. Monetize and maximize profits from your social media platforms.

“Social Media Marketing” is a resource for anyone who has little-to-no social media presence. Learn how to grow an interactive follower base organically. Get proven strategies for Facebook, Twitter, Instagram, YouTube, and Snapchat. Increase interaction of your followers. Monetize and maximize profits from your social media platforms.  Building on insights from cognitive psychology and neuroscience, “The Sea We Swim In” shows how to see the world in narrative terms. Learn how a story can help you establish a brand identity and turn consumers into fans.

Building on insights from cognitive psychology and neuroscience, “The Sea We Swim In” shows how to see the world in narrative terms. Learn how a story can help you establish a brand identity and turn consumers into fans. “Customer Experience Excellence” is a guide to creating a successful customer experience platform. Drawing on the research of the global consulting group KPMG, the book details the winning systems of companies that have produced authentic customer communication systems at scale.

“Customer Experience Excellence” is a guide to creating a successful customer experience platform. Drawing on the research of the global consulting group KPMG, the book details the winning systems of companies that have produced authentic customer communication systems at scale.  “Fast Fulfillment” explores the ins and outs of the delivery side of online businesses. Learn the secrets of fast fulfillment, and design a plan for your own disruptive innovation.

“Fast Fulfillment” explores the ins and outs of the delivery side of online businesses. Learn the secrets of fast fulfillment, and design a plan for your own disruptive innovation. “Leadership for Founders” provides proven practices on how to be a leader who fosters innovation, attracts the right talent, and retains customers. Launching a new project is difficult when the long-term survival rate is so low. Explore these best practices to ensure success for you, your team, and your organization. Paperback $19.95.

“Leadership for Founders” provides proven practices on how to be a leader who fosters innovation, attracts the right talent, and retains customers. Launching a new project is difficult when the long-term survival rate is so low. Explore these best practices to ensure success for you, your team, and your organization. Paperback $19.95. “Decisively Digital” explores how to survive and thrive in an increasingly digital world. Learn how to establish a digital culture and realize the benefits of modern work for your employees. Take advantage of analytics, big data, and cloud computing. Explore how digital innovation can drive your business results. Paperback $25.00; Kindle $15.00.

“Decisively Digital” explores how to survive and thrive in an increasingly digital world. Learn how to establish a digital culture and realize the benefits of modern work for your employees. Take advantage of analytics, big data, and cloud computing. Explore how digital innovation can drive your business results. Paperback $25.00; Kindle $15.00.