E-commerce merchants are literally at the mercy of the digital checkout systems tied to their web stores. For retailers, what happens on the other side of the “pay” button is critical to avoiding denied approvals. Online sellers cannot survive without a strong checkout page.

The process can be a dizzying integration of numerous moving parts. Authentication, currency conversions, and approval rates all must work together to ensure a quick and complete transaction so merchants can bring their business to the next level.

How fast money moves in a transitioning digital economy is a sign of efficiency and health. So what does it mean when $18 trillion in U.S. business-to-business payments takes days to clear and land in bank accounts?

For merchants, it means lost efficiency and lost time to put cash to work. For consumers, such delays mean they do not have access to funds that many of them need right now. For both parties, it also means failed transactions.

This process is changing slowly. The payment system that runs much of the online transactions is 40 years old. Some investors have taken notice. A new behind-the-scenes payment system is slowly taking over.

Developed by The Clearing House, RTP (Real-Time Payments) is backed by major U.S. banks and has been adopted by nearly 40 percent of large enterprises in the U.S.

RTP represents the new frontier for payments and will likely become the new standard. Already, more than one-third (36 percent) of large enterprises in the U.S. use Real-Time Payments, which was launched in 2017 in the United States. However, beyond U.S. borders, RTP is in much bigger use.

RTP’s prominence is likely to expand. Levvel Research’s “2021 Real-Time Payments Market Report,” showed that 66 percent of companies in the U.S. indicate they are likely to adopt RTP in the next two years. The technology has already gained momentum in other countries.

RTP is a big step to speeding up and modernizing payments, accounting, and money movement. RTP enables financial institutions and businesses to send and receive payments in real time. The process is much faster than checks, ACH, or wires, which can take up to three days to clear.

Other than speed, RTP differs from the way B2B payments are made today in that it enables three new processes.

- Better data to drive better insights.

With non-RTP transactions, vendors, at best, may see their clients’ payments post to their bank account. RTP enables data to transfer with the payment, so companies get visibility into invoices, dates, purchase orders, and more.

This gives companies an advantage in responding to customer needs and has potential to improve their finance function and decision-making.

- Continuous availability.

RTP is always available. This provides merchants with more flexibility than traditional banking hours that constrain non-RTP payments.

- The mitigated risk of payment failure.

RTP payments are irrevocable. Payment instructions are not sent unless there are sufficient funds. This reduces the risk of payment exceptions.

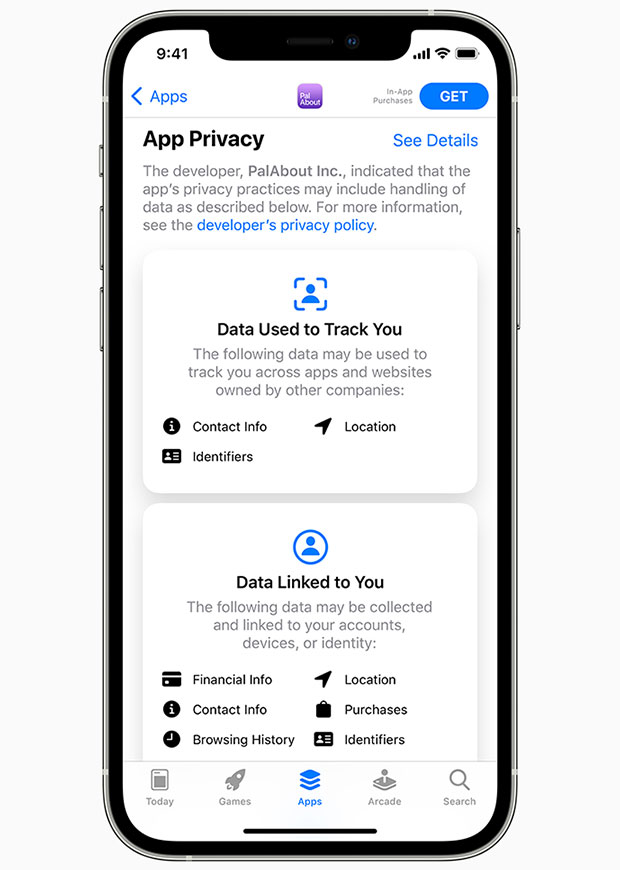

From a merchant’s viewpoint, three levels of optimization are needed for a seamless checkout experience. They are improvements to checkout, integration, and issuer responses.

They can provide a customer with the most seamless experience, increasing the likelihood of completing a purchase. This also will make it easy for merchants to keep track of their transactions and get the most from their shoppers.

- Checkout optimization reduces the number of steps a consumer needs to take when paying for goods online. Fewer steps mean less frustration and fewer abandoned baskets.

- Integration optimization means not making consumers insert their credit card details into a website they do not trust. So ensuring a payment gateway that is properly configured and integrated into the checkout process with the same look and feel as the rest of the experience is critical.

That optimization should include the authorization process and structured data that informs merchants about their business transactions. This way, merchants can quickly identify where any declines come from in the processing chain, what the reason for it is, and oversee the smooth flow of transactions.

- Issuer optimization is the final cog in the payment wheel. Once payment has passed through the gateway and the acquirer, the final decision on whether to authorize a transaction ultimately sits with the issuer.

What happens on the other side of the pay button is critical. A maze of steps must execute without glitches to complete transactions successfully. Even if a customer commits to a purchase, enters the details, and clicks the pay button, the order will not necessarily be successful, as all sorts of variables such as authorization rates come into play here.

Multiple parties are involved in every transaction. Each has the power to cause a transaction to fail and impact a merchant’s approval rates. That is why it is so vital that merchants work with a payments partner that looks after this process for them.

RTP is inevitable because the speed of business and economies is only getting faster. Companies cited immediate access to funds as the most appealing benefit of RTP. Also, 76 percent of companies believe RTP will provide them with a competitive advantage.

As more companies adopt, others will, too, in order to stay competitive. In addition to RTP, the Federal Reserve is forging ahead with its real-time payment system, FedNow, which is expected in 2023 or 2024.

For consumers, real-time payments will mean instant access to funds with no more waiting for checks to clear. For some consumers who live paycheck to paycheck, that could reduce the need for expensive, short-term loans or reduce chances of bank overdrafts.

In addition, RTP will speed up operational requirements of foundational back-office processes like accounts receivable and accounts payable, potentially leading to lower costs. It goes without saying that these savings can result in increased incremental value for their customers.